In today's India, having health insurance isn’t just a smart choice—it’s essential. With the rising cost of medical treatments and unpredictable health emergencies, protecting your family with the right policy can save you from serious financial hardship.

If you're searching for a trusted and comprehensive health insurance provider, ManipalCigna Health Insurance is a name you can rely on. Known for their excellent claim settlement ratio and wide range of plans, ManipalCigna offers something for everyone—from budget-friendly plans to premium lifelong coverage.

This blog covers everything about manipal cigna health insurance, including detailed plan information, premium expectations, how to easily download your Manipal Cigna policy, and honest manipal cigna insurance reviews to help you make the best choice in 2025.

Before we dive into the plans, let’s talk about what makes ManipalCigna an excellent choice for many Indians:

💡 Get Your Personalized Premium Quote

The ManipalCigna Sarvah series is their flagship line of health insurance plans designed for Indian families at different stages.

Sarvah Pratham is the entry-level plan and one of the most affordable in the market. You can get coverage starting from just ₹433 per year, with sum insured options ranging from ₹5 Lakh to ₹3 Crore. While it comes with standard waiting periods—30 days for most illnesses and up to 36 months for pre-existing diseases—the plan offers a unique Sarathi benefit which can significantly reduce waiting times for common conditions such as diabetes, hypertension, and asthma to just 30 days.

Moving up, the Sarvah Uttam plan includes everything Pratham offers, plus important extras. If you’re worried about critical illnesses like cancer, stroke, or heart diseases, Uttam provides unlimited coverage for these conditions. It also includes maternity and newborn baby coverage up to 20% of the sum insured, a valuable feature for young families planning for children. This plan also offers personal accident cover up to ₹3 Crore and provides an unlimited restoration benefit, meaning if your sum insured is used up due to claims, it can be restored so you have coverage again within the same policy year.

The premium for Sarvah Uttam starts higher, at around ₹4,842 per year, but the added benefits and comprehensive coverage often outweigh the cost for growing families.

Then there’s the Sarvah Param plan, designed for immediate protection without any waiting period for illnesses, including all pre-existing conditions. This is a rare benefit in the Indian insurance market and helpful if you want full coverage from day one to avoid gaps in protection. It includes all Uttam benefits plus the Tatkal benefit that removes waiting periods altogether. The starting premium for this plan is approximately ₹7,668 per year.

Sarvah plans cover not only hospitalization but also day care procedures, domiciliary hospitalization, ambulance services, and pharmacy expenses. They allow for accommodation in private rooms ensuring comfort during hospital stays.

👉 See Sarvah Plan Benefits & Buy Online

If you’re looking for more than just basic cover and prefer security that lasts a lifetime, the ManipalCigna Lifetime Health Plan is the right choice. It is ideal for families who want coverage up to ₹3 Crore.

This plan covers 27 major critical illnesses such as cancer, cardiac arrests, strokes, and organ transplants. Importantly, it offers global cancer treatment, which is becoming vital as many Indians seek treatment overseas for advanced therapies. You also get lifelong renewability, meaning you can keep the policy without age limits, offering worry-free protection for senior family members too.

Lifetime Health also gives a cumulative bonus of 15% on the sum insured every year without making any claims, helping your coverage grow with increasing medical inflation. Plus, if you get diagnosed with a critical illness, your premium waiver benefit lets you stop paying premiums while the policy stays active.

The premium for this plan is higher than Sarvah but reasonable for the level of protection it offers, usually starting from ₹10,000 and above depending on your age and coverage.

✅ Check Lifetime Health Premiums

For younger Indians who want good health insurance without paying too much, the ProHealth Prime series offers balanced coverage.

These plans also include wellness programs, teleconsultations, and other health supports that match the lifestyles of working professionals in India. Premiums vary by sum insured and age but are very affordable compared to high-end plans.

🔗 Explore ProHealth Prime Options

For those aged between 56 and 75, the Prime Senior Classic and Elite plans cater specifically to the health needs of senior citizens.

The Classic plan covers sums insured between ₹3 Lakhs to ₹50 Lakhs, with a 20% co-payment (meaning you pay 20% of claim costs). It provides pre-hospitalization coverage of 30 days and 60 days post-hospitalization, along with one health check-up per claim-free year.

The Elite plan has enhanced benefits—higher sum insured options (₹5 Lakhs to ₹50 Lakhs), no co-payment, longer pre and post-hospitalization coverage, and even an air ambulance benefit up to ₹10 Lakhs. It also offers free annual health check-ups and a premium waiver on serious illness.

These plans are tailored to meet the specific concerns of elderly Indians with frequent hospital visits and chronic care needs.

👵 Get a Senior Citizen Quote Now

If you already have health insurance but want extra coverage for major medical expenses, Super Top-Up plans are a cost-effective solution.

You select a deductible (the amount your base policy pays first) from ₹1 Lakh to ₹10 Lakhs, and the Super Top-Up plan covers hospitalization and day care treatment costs above that. Coverage ranges from ₹3 Lakhs to ₹30 Lakhs with premiums starting around ₹1,700 per year.

These plans suit middle-class Indians who want protection against high medical bills without paying hefty premiums for standalone large sum insured plans.

➕ Calculate Your Super Top-Up Premium

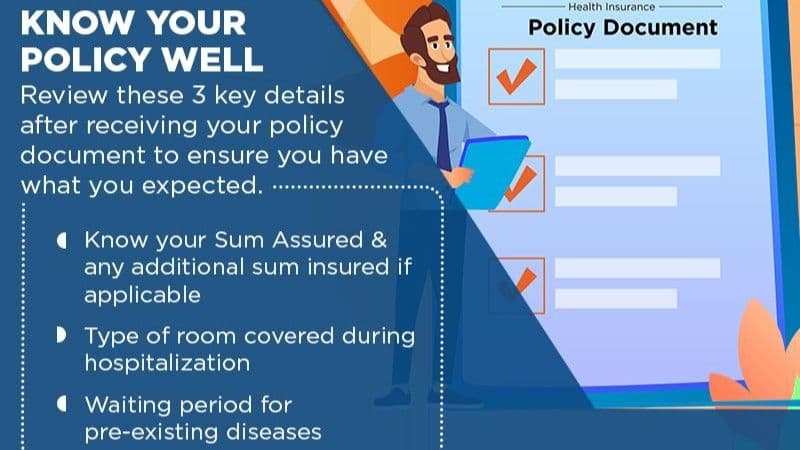

Managing your health insurance paperwork is simple with ManipalCigna:

This easy process ensures you always have quick access to your policy documents during emergencies.

📲 Download or Renew Your Policy Instantly

Premiums vary based on your age, plan choice, and the sum insured you select.

💰 Use the Official Premium Calculator

Indian customers consistently praise ManipalCigna for:

Over 50 lakh Indians trust ManipalCigna to protect their health and finances.

⭐ Read More Customer Reviews & Apply

Q: What is the lowest premium available? A: Sarvah Pratham plans can be availed from ₹433 per year.

Q: Can I cover my family, including parents, with one policy? A: Yes, family floater options allow you to cover spouse, children, and dependent parents under a single sum insured.

Q: Are pre-existing diseases covered immediately? A: The Sarvah Param plan offers zero waiting period even for pre-existing diseases. Other plans have waiting periods ranging from 30 days to 36 months, often reduced by the Sarathi benefit.

Q: How many hospitals accept ManipalCigna cashless claims? A: ManipalCigna has a network of over 15,000 empaneled hospitals all over India.

Q: Are ManipalCigna premiums tax-deductible? A: Yes, premiums paid qualify for income tax deductions under Section 80D of the Income Tax Act.

With affordable premiums starting as low as ₹433 and coverage options up to ₹3 Crore, ManipalCigna offers health insurance plans designed to meet the varied needs of Indian families.

Whether you want value-for-money protection with the Sarvah Pratham, comprehensive global coverage with Lifetime Health, or specialized care for seniors, ManipalCigna has a plan for you.

Get your Manipal Cigna health insurance today—download your policy online, check your premium with their calculator, and secure your family’s health with trusted coverage. Remember, the right policy not only safeguards your savings but also gives you the peace of mind that expert medical support and fast claim settlement will be there when you need it most.

🚀 Secure Your Family’s Health – Get a Free Quote & Buy Today